In-Home Care Insurance Coverage Explained: Your Complete Guide to Medicare, Medicaid, LTC Insurance, Veterans Benefits, and Private Pay

Navigating in-home care insurance coverage options can feel overwhelming, but understanding Medicare, Medicaid, long-term care insurance (LTCi), veterans benefits, and private pay strategies empowers families to secure personalized support at home. This guide defines in-home care services, clarifies Activities of Daily Living (ADLs) and Instrumental Activities of Daily Living (IADLs), examines each coverage type—including eligibility, covered services, and limitations—and outlines how to combine options for maximum benefits while scheduling a free assessment with Heritage Senior Care.

What Is In-Home Care and How Is It Covered by Insurance?

In-home care provides medical and non-medical assistance where seniors live to maintain independence, manage chronic conditions, and support daily routines. Families often fund these services through a mix of government programs, private insurance, and out-of-pocket payments to ensure continuity of care.

What Services Are Included in In-Home Care?

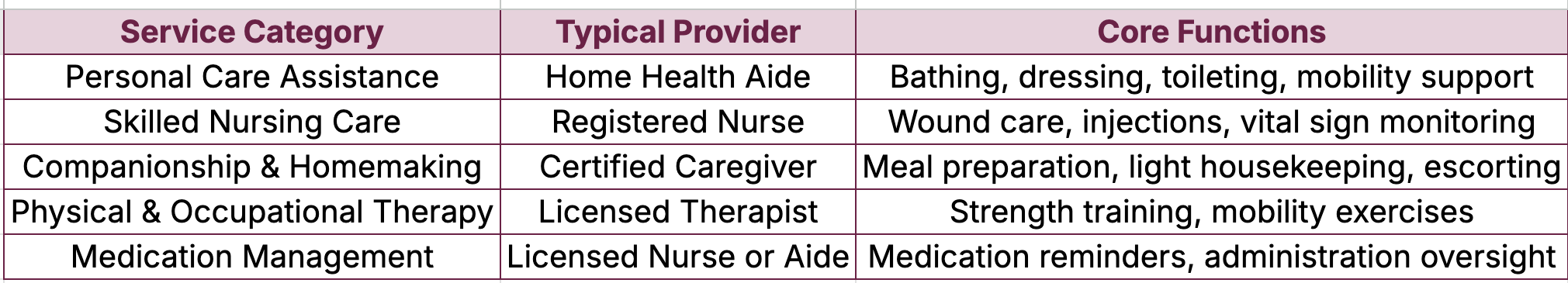

Below is an overview of core service categories delivered at home:

These services range from hands-on personal care to specialized treatment, preparing us to explore how insurance and payment options fund them.

How Do Insurance Policies and Payment Options Fund In-Home Care?

In-home care financing hinges on several sources:

Medicare covers short-term, medically necessary home health care for homebound individuals.

Medicaid offers personal care and nursing services for low-income seniors, often via Home and Community-Based Services (HCBS) waivers.

Long-Term Care Insurance (LTCi) triggers benefits based on ADL or cognitive impairment assessments.

Veterans Benefits such as Aid and Attendance and Housebound pensions supplement care costs for eligible veterans.

Private Pay allows direct out-of-pocket payments, granting flexibility in service level and schedule.

Combining these sources reduces gaps and connects families to tailored support pathways.

What Are Activities of Daily Living (ADLs) and Instrumental Activities of Daily Living (IADLs)?

ADLs and IADLs assess functional needs:

Activities of Daily Living (ADLs) are basic self-care tasks: Bathing and showeringDressing and groomingEating and drinkingToileting and continenceTransferring (bed/chair)

Instrumental Activities of Daily Living (IADLs) are complex skills needed for independent living: Meal preparation and shoppingHousekeeping and laundryMedication managementManaging financesTransportation and appointment coordination

Insurance eligibility often hinges on needing assistance with two or more ADLs, linking functional assessment to funding approval.

Why Is Understanding Insurance Coverage Important for Seniors and Caregivers?

Clear knowledge of coverage options prevents unexpected costs and service interruptions. Families who grasp eligibility criteria can:

Optimize benefit timing (e.g., scheduling therapy under Medicare).

Avoid high out-of-pocket expenses by leveraging Medicaid waivers or VA pensions.

Plan proactive transitions between coverage types to maintain consistent care.

This awareness underpins informed discussions with Heritage Senior Care during a free assessment and ensures seniors receive uninterrupted support.

How Does Medicare Cover In-Home Care?

Medicare supports home health care under Parts A and B for homebound individuals requiring skilled services.

What Are Medicare Part A and Part B Home Health Benefits?

Medicare Part A and Part B cover medically necessary in-home services:

Definition: Covered under "Home Health Care" when ordered by a physician.

Mechanism: Benefits are funded 100% for covered services with no deductible or coinsurance.

Benefits: Skilled nursing, physical therapy, occupational therapy, speech therapy, home health aide visits, and medical social services.

Enrollment in Part A and Part B ensures seniors can receive these skilled services without direct billing.

Medicare Coverage for Home Health Services

Medicare Part A and Part B cover home health services for individuals who are homebound and require skilled care. Covered services include skilled nursing, physical therapy, occupational therapy, speech therapy, and home health aide services when combined with skilled care.

This source clarifies the specific services covered by Medicare, which is essential for understanding how to finance in-home care.

Who Qualifies as Homebound Under Medicare?

Functional Limitation: Difficulty leaving home without assistance or taxing effort.

Absence Exceptions: Short medical or therapeutic outings (e.g., dialysis) do not disqualify.

Provider Certification: A physician must certify homebound status and medical necessity.

Meeting homebound criteria triggers eligibility for home health benefits and aligns with coverage mechanics under Part A or B.

What Skilled Nursing and Therapy Services Does Medicare Cover?

Skilled Nursing Care: Wound dressing changes, injections, IV therapy.

Therapy Services: Physical therapy for mobility, occupational therapy for ADL training, speech therapy for communication/swallowing.

These services aim to restore or maintain function, reducing hospitalization and supporting recovery at home.

What Does Medicare Not Cover in In-Home Care?

Long-Term Personal Care: Assistance solely with ADLs or IADLs when no skilled need exists.

24/7 Care: Round-the-clock custodial support.

Homemaker Services Alone: If not combined with skilled services.

Planning for non-covered care often involves LTCi or private pay strategies to fill gaps.

How Do Medicare Advantage Plans Affect In-Home Care Coverage?

Expanded Benefits: Additional therapy sessions or home modifications.

Network Requirements: Services must come from plan-approved providers.

Cost Sharing: Varies by plan; check benefit brochures for specific in-home care coverage.

Choosing an Advantage plan involves comparing home health benefits and network providers to ensure adequate in-home support.

What Are Medicaid Eligibility Requirements and Coverage for In-Home Care?

Medicaid provides comprehensive in-home support for eligible low-income seniors through state programs and HCBS waivers.

How Do Financial and Functional Eligibility Affect Medicaid Home Care?

Income Limits: Varies by state, often aligned with Federal Poverty Level percentages.

Asset Restrictions: Caps on countable assets such as savings and investments.

Functional Assessment: Demonstrating need for ADL or IADL assistance qualifies for personal care benefits.

Meeting both financial and functional criteria unlocks state-administered home care services tailored to care level.

What Services Does Medicaid Cover for In-Home Care?

Medicaid funds:

Personal care assistance (bathing, dressing).

Skilled nursing visits and therapies.

Home health aide services under supervision.

Medical equipment and supplies.

Coverage breadth depends on state plan provisions, offering a robust alternative to institutional care.

Medicaid's Role in Funding In-Home Care

Medicaid provides in-home care services through state programs and Home and Community-Based Services (HCBS) waivers for eligible low-income seniors. These programs offer personal care assistance, skilled nursing, and therapies, providing an alternative to institutional care.

Paying for Senior Care, Medicaid and In-Home Care: Eligibility, Benefits & State Rules (2025-01-21)

This citation highlights Medicaid's role in offering in-home care, which is a key component of the financing options discussed in the article.

How Do Home and Community-Based Services (HCBS) Waivers Work?

Waive Institutional Rules: Provide home care instead of nursing home placement.

Customize Services: Offer adult day care, respite care, and assistive technologies.

Cap Enrollment: Manage waiver slots to control costs.

Waiver participation often expedites access to tailored in-home support for seniors at risk of institutionalization.

What Are State-Specific Medicaid Programs for In-Home Care?

California’s In-Home Supportive Services (IHSS).

New York’s Consumer Directed Personal Assistance Program (CDPAP).

Texas STAR+PLUS Home and Community-Based Services Waiver.

Exploring state resources ensures families maximize local benefits and waiver options.

What Are Common Medicaid Coverage Gaps and How Can They Be Bridged?

Waiting Lists: Waiver slot shortages.

Service Limits: Hourly caps on personal care.

Geographic Variations: Differences in reimbursement rates.

Bridging strategies involve private pay supplements, veteran benefits, or short-term LTC insurance claims to maintain uninterrupted support.

How Does Long-Term Care Insurance (LTCi) Support In-Home Care?

LTCi provides daily benefit payments when care triggers are met, funding both medical and non-medical services at home.

What Are the Key Features of LTC Insurance Policies for Home Care?

Benefit Trigger: Need for assistance with ADLs or cognitive impairment.

Elimination Period: Waiting days before benefits begin (commonly 30–90 days).

Daily Benefit Amount: Fixed dollar limit per day for services.

Inflation Protection: Optional rider increasing benefits over time.

Understanding these features guides policy selection to match anticipated care needs.

Which In-Home Services Are Typically Covered by LTCi?

LTCi generally covers:

Personal care assistance (bathing, dressing).

Homemaker and respite services.

Skilled nursing when required by plan language.

Adult day health care programs.

Long-Term Care Insurance and Covered Services

Long-Term Care Insurance (LTCi) policies typically cover a range of in-home services, including personal care assistance, homemaker services, and skilled nursing care, depending on the policy's terms and conditions. Benefit eligibility is often triggered by the need for assistance with Activities of Daily Living (ADLs) or cognitive impairment.

This source explains the services typically covered by LTCi, which is crucial for understanding how this insurance type supports in-home care.

Coverage definitions vary; policyholders should review service schedules and provider requirements.

How Do Daily Benefit Limits and Elimination Periods Affect Coverage?

Shorter Elimination Periods start benefits sooner but often increase premiums.

Higher Daily Limits allow more hours of paid care per day.

Combination Strategies with private pay fill the gap during elimination days.

Balancing premiums and benefit design optimizes coverage for projected home care durations.

How Can You Choose the Right LTC Insurance Policy for In-Home Care?

Benefit Amount vs. Premium: Align daily limits with local care rates.

Policy Definitions: Clarify what constitutes "skilled" versus "custodial" care.

Inflation Riders: Safeguard against rising care costs.

Provider Networks: Verify acceptance of preferred home care agencies.

A policy matched to individual health risk and financial plan ensures coverage when care is needed.

What Is the Process for Filing LTC Insurance Claims?

Obtain Physician Certification: Documentation of ADL impairment.

Submit Claim Forms: Include medical assessments and provider invoices.

Provider Verification: Insurance monitors care necessity and service dates.

Benefit Disbursement: Payments sent directly to policyholder or care provider.

Efficient claim management reduces delays in receiving benefit funds for home care services.

What Veterans Benefits Are Available for In-Home Care?

VA programs provide financial and service support to eligible veterans and spouses requiring in-home assistance.

Who Is Eligible for VA Aid and Attendance Pension Benefits?

Veteran or Surviving Spouse: Must have served 90 days of active duty with at least one wartime period:

World War II: December 7, 1941 – December 31, 1946.

Korean Conflict: June 27, 1950 – January 31, 1955.

Vietnam War Era: February 28, 1961 – May 7, 1975 (in-country), or August 5, 1964 – May 7, 1975 (outside Vietnam).

Gulf War: August 2, 1990 – Present (through a future date to be set by law).

Mexican Border Period: May 9, 1916 – April 5, 1917.

World War I: April 6, 1917 – November 11, 1918.

Income and Net Worth Limits: Income below set thresholds with countable assets under federal cap.

Need for Assistance: Requires help with ADLs or supervision due to mental incapacity.

Aid and Attendance supplements monthly pension amounts by up to $2,127 for a couple, helping cover home care costs.

VA Benefits for In-Home Care

Veterans Affairs (VA) offers Aid and Attendance and Housebound benefits to eligible veterans and surviving spouses, providing financial assistance for in-home care costs. These benefits supplement the monthly pension and can be used to cover expenses for personal care or skilled services.

Veterans Affairs, VA Aid and Attendance Benefits and Housebound Allowance (2024-07-18)

This citation explains the VA benefits available for in-home care, which is a key funding source for eligible veterans.

What Is the Housebound Benefit for Veterans?

Additional Stipend: For veterans confined substantially to home due to permanent disability.

Parallel Support: Can be awarded alongside Aid and Attendance if criteria are met.

Funding Use: Can offset expenses for home modifications, personal care, or skilled services.

These VA payments create a reliable supplement to other funding sources for in-home support.

How Does the VA Homemaker and Home Health Aide Program Work?

Service Delivery: Trained aides provide personal care and homemaking tasks in the veteran’s home.

Referrals Through VA: Coordinated by VA Medical Centers and Community Care Networks.

No Direct Cost: Services funded fully by the VA for eligible veterans.

Integrating this program with Medicare or Medicaid services enhances comprehensive home care planning.

What Is the Community Care Network and How Does It Provide Home Care?

Referrals to Local Providers: Coordinates care when VA facilities are unavailable.

Coverage Scope: Includes home health services under VA authorization.

Authorization Process: Primary care provider submits referral for CCN-covered in-home care.

CCN expands veteran access to in-home services beyond VA facilities, ensuring local continuity of care.

How Do You Apply for VA Home Care Benefits?

Complete VA Form 21-2680: Aid and Attendance and Housebound Benefits Questionnaire.

Submit Supporting Documents: Medical evaluations, financial records, discharge papers.

Work with a Veterans Service Officer (VSO): Ensures accurate paperwork and follow-up.

Await Decision: VA typically responds within 4–6 months; benefits start retroactively to application date.

Timely application secures supplement payments that fund in-home care services. If you have any questions, please call us!

What Are Private Pay Options and Costs for In-Home Care?

Private pay enables direct payment for care services, affording flexibility in provider choice and scheduling.

How Much Does Private Pay In-Home Care Cost Per Hour and Month?

Typical cost ranges:

Hourly Rates: $45–$60 per hour for non-medical care (personal assistance, companionship).

Monthly Costs: For 40 hours/week, approximately $4,000–$6,800. However, please note that most do not require 40 hours a week!

Around-the-Clock Care: 24/7 support can exceed $27,000 per month.

Private Pay Costs for In-Home Care

Private pay for in-home care involves direct payments for services, with costs varying based on factors such as geographic location, level of care, and provider type. Hourly rates typically range from $45 to $60 for non-medical care, and monthly costs can be substantial, especially for around-the-clock support.

Local variations in labor rates and service levels drive price differences.

What Factors Influence Private Pay Rates for Home Care?

Geographic Location: Metropolitan areas command higher wages.

Level of Care: Skilled nursing versus companion services.

Provider Type: Agency-based services often cost more than independent aides.

Overnight or Holiday Premiums: Additional fees for off-peak hours.

Understanding rate drivers helps families budget and compare quotes effectively.

What Financial Strategies Can Help Manage Private Pay Costs?

Reverse Mortgages: Convert home equity to income for care expenses.

Annuities: Provide guaranteed income streams earmarked for long-term care.

Life Insurance Conversions: Accelerated death benefits can fund care needs.

Personal Savings Plans: Health savings accounts (HSAs) and retirement assets.

Combining these strategies with insurance benefits reduces out-of-pocket burdens.

What Are the Benefits of Private Pay Compared to Insurance Coverage?

Immediate Access: No waiting periods or benefit triggers.

Customized Care Plans: Flexible scheduling and service combinations.

Provider Choice: Freedom to select independent aides or specialized agencies.

Balancing private pay with insurance filling gaps ensures both flexibility and financial protection.

How Does Private Pay Complement or Replace Insurance Options?

Bridge Coverage Gaps: Cover elimination periods on LTCi policies or copays under Medicare Advantage.

Supplement Uncovered Services: Fund homemaker or companionship services excluded by government programs.

Fallback Option: When eligibility lapses, private pay maintains continuity of care.

Strategic use of private pay optimizes the care continuum and minimizes service interruption.

How Can Families Make Informed Decisions About In-Home Care Insurance Coverage?

Combining insights on coverage types, costs, and eligibility empowers families to craft a cohesive plan.

How Can Combining Multiple Coverage Options Maximize Benefits?

Apply Medicare First: Use home health benefits for skilled services.

Activate Medicaid Waivers: If eligible, secure personal care assistance.

Tap LTCi Benefits: Cover non-medical ADL support when triggers are met.

Claim VA Pensions: Supplement income for care costs.

Use Private Pay Strategically: Fill short-term gaps and fund extras.

Coordinating benefits reduces out-of-pocket expenses and ensures comprehensive support.

Why Is Early Planning for Long-Term Care Important?

Proactive planning allows:

Better Policy Options: Younger applicants secure lower LTCi premiums and broader benefits.

Asset Protection: Structured Medicaid applications preserve more assets.

Psychological Preparedness: Families avoid crisis-driven decisions under stress.

Early planning transforms uncertainty into a structured care roadmap.

What Are Common Coverage Gaps and How Can They Be Addressed?

Frequent gaps include:

Medicare’s Exclusion of Personal Care: Use private pay or LTCi to fund ADL support.

Medicaid Waiver Waiting Lists: Supplement with private pay until waiver enrollment.

LTCi Elimination Periods: Bridge with private funds or short-term care loans.

Identifying gaps early permits timely interventions to maintain seamless services.

How Can Caregivers Navigate the Emotional and Financial Challenges?

Support strategies:

Engage Professional Advisors: Geriatric care managers and financial planners provide guidance.

Seek Support Groups: Peer networks share experiences and coping techniques.

Utilize Respite Services: Scheduled breaks preserve caregiver well-being.

Plan Regular Assessments: Ensure evolving needs align with coverage and budgets.

Holistic support addresses both logistical and emotional dimensions of caregiving.

When and How Should You Schedule a Free Assessment for Personalized Guidance?

Families should request a free assessment when:

Care Needs Emerge: Difficulty with ADLs or medication management arises.

Insurance Questions Arise: Clarification on eligibility or policy details is needed.

Service Transitions Occur: Moving from hospital to home or adjusting care levels.

Planning Ahead: Early in retirement or upon changes in health status.

Contact Heritage Senior Care to arrange an in-home or virtual assessment, ensuring a customized care plan aligned with insurance coverage and family goals.