Affordable Elderly Caregiver Options for In-Home Care: Your Complete Guide to Cost-Effective Senior Support

Elderly individuals seeking to age in place often face overwhelming care costs and limited support options; this guide reveals how affordable in-home caregiver solutions combined with government aid, community programs, and technology can ease financial burden while preserving independence. You’ll discover federal and state assistance programs, true cost comparisons versus residential care, alternative day-time and respite solutions, proven vetting strategies for quality caregivers, key legal and financial planning steps, and emerging tech tools that streamline affordable support. Whether you need part-time personal care or a hybrid model of supervision and remote monitoring, each section delivers definitions, mechanisms, and real-world examples to empower your decision at every level.

What Government Assistance Programs Help Pay for Affordable In-Home Elderly Care?

Medicaid, VA benefits, HUD housing vouchers, and local non-Medicaid initiatives collectively reduce out-of-pocket expenses by offering care funding, housing subsidies, and diversion programs to keep seniors safely at home. Understanding these resources allows low-income and veteran seniors to leverage existing government services for home health aides, homemaker support, and affordable housing.

How Does Medicaid Support In-Home Care for Seniors?

Medicaid covers long-term home and community-based services for eligible seniors by assessing financial need and care requirements, enabling low-income individuals to receive personal care in familiar surroundings. States determine income and asset limits—often aligned with Supplemental Security Income thresholds—to qualify beneficiaries, while functional assessments gauge assistance needs for Activities of Daily Living (ADLs) such as bathing, dressing, and meal preparation.

Key Medicaid Coverage Components:

Personal care assistance with ADLs and Instrumental ADLs (IADLs)

Homemaker services including light housekeeping and meal planning

Adult day health programs offering social engagement and health monitoring

These services ensure seniors maintain independence, and seamless state-federal partnership accelerates application approvals through coordinated assessments.

Medicaid and Home-Based Services

Medicaid provides significant support for seniors who wish to remain in their homes, covering a range of services from personal care to homemaker assistance. These services are designed to help individuals with Activities of Daily Living (ADLs) and Instrumental Activities of Daily Living (IADLs), ensuring they can maintain their independence while receiving necessary care.

Centers for Medicare & Medicaid Services, Medicaid.gov

This information supports the article's claims about Medicaid's role in providing home-based care for seniors.

What Are Medicaid Home and Community-Based Services (HCBS) Waivers?

HCBS waivers provide flexible alternatives to institutional care by reallocating nursing home funding into home-based support and community services. Through waivers, states cover personal care, respite, adult day care, and even minor home modifications—ensuring each service aligns with individual needs rather than defaulting to costly facilities.

This flexible structure places decision-making power in seniors’ hands and prevents premature nursing home placement by delivering personalized support.

How Can Veterans Benefits Assist with Senior In-Home Care Costs?

Veterans Affairs (VA) Aid and Attendance benefits allow qualifying veterans and surviving spouses to receive monthly allowances that cover non-medical care at home. With eligibility based on service history, income thresholds, and medical necessity for daily assistance, these benefits help pay for home health aides, companion services, and personal care.

Key eligibility criteria include:

Minimum 90 days of active duty with at least one wartime service period.

Documentation of need for assistance with ADLs.

Income verification below specified net worth and income limits.

Provision of Aid and Attendance reduces family expenses by offsetting private caregiver fees, and survivors can transfer unused benefit balance to pay for household modifications that improve safety.

Veterans Affairs Aid and Attendance Benefits

Veterans and surviving spouses may be eligible for Aid and Attendance benefits, which provide financial assistance for non-medical care at home. Eligibility depends on service history, income, and the need for assistance with daily activities, helping to offset the costs of home health aides and other care services.

U.S. Department of Veterans Affairs, VA.gov

This citation reinforces the article's discussion of how veterans can access financial aid for in-home care.

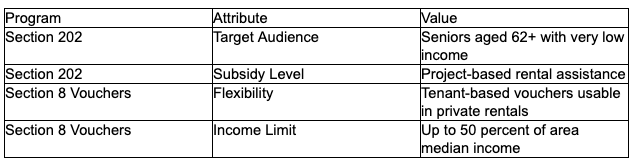

What HUD Housing Assistance Programs Are Available for Low-Income Seniors?

HUD’s Section 202 Supportive Housing program and Section 8 Housing Choice Vouchers enable seniors with limited incomes to afford safe, accessible homes near essential services. By subsidizing up to 50–70 percent of rent, these programs free household funds for caregiver wages and health-related expenses.

These housing subsidies strengthen financial stability by coupling affordable living arrangements with accessible in-home care funding.

Are There State-Specific Non-Medicaid Programs for Affordable Elderly Care?

Many states offer nursing home diversion initiatives, senior care grants, and local nonprofit partnerships that bridge gaps in Medicaid coverage. Programs vary by region but often include caregiver training stipends, low-cost home safety modifications, and subsidized adult day health slots to delay or prevent institutional placement.

Common state-level offerings:

Caregiver stipend programs compensating family caregivers.

Home modification loans for ramps, grab bars, and accessible bathrooms.

Local nonprofit referrals connecting seniors with volunteer companions.

By layering state resources atop federal assistance, seniors create a robust support network that maximizes affordability and maintains quality of life.

How Much Does In-Home Elderly Care Cost Compared to Other Care Options?

Assessing in-home care costs alongside assisted living and nursing homes reveals that part-time home care often provides the most cost-effective solution for moderate needs, while full-time residential settings may offer economies of scale for intensive services.

What Is the Average Cost of In-Home Care for Seniors?

In-home personal care averages $26–$44 per hour in Southern California, translating to $17,000–$29,000 monthly for 24/7 services in high-cost regions.

Seniors pairing part-time visits with remote monitoring can further reduce direct caregiver hours, making in-home care more sustainable.

How Does In-Home Care Compare to Assisted Living and Nursing Home Costs?

Assisted living communities average $4,300 per month for room, board, and personal care, while nursing homes range from $7,500 to $10,000 monthly for skilled nursing and medical supervision. Although comprehensive, residential options bundle housing, utilities, and care into a single fee—sometimes providing lower per-hour care rates at the expense of independence. Additionally, sometimes families choose to provide a caregiver to their loved while at the assisted living for additional supervision, care and mobility. Those costs vary and are not factored in to the estimates above.

Choosing between options depends on care intensity, desire for autonomy, and budget flexibility, guiding families toward the most fitting model for their circumstances.

What Are the Hidden Costs of Family Caregiving?

Beyond direct wages, informal caregiving carries emotional strain, lost income, and potential health expenses when family members sacrifice work hours or personal well-being.

Common indirect costs include:

Lost wages from reduced employment or early retirement.

Out-of-pocket supplies such as incontinence products and medical equipment.

Mental health impacts requiring counseling or stress management.

Recognizing these hidden burdens highlights the true value of subsidized home care, which offsets not only direct costs but also protects caregiver health and family finances.

How Can Financial Planning Help Manage Long-Term In-Home Care Expenses?

Strategic use of long-term care insurance, reverse mortgages, and Medicaid spend-down planning aligns assets with eligibility requirements while preserving home equity and minimizing out-of-pocket payments.

Key tactics include:

Long-Term Care Insurance – Pays daily benefit toward personal care costs when triggers are met.

Reverse Mortgage – Converts home equity into tax-free funds for care services.

Medicaid Spend-Down – Legally reallocates assets into exempt categories to qualify for assistance.

Integrating these approaches ensures a sustainable funding plan that adapts as care needs evolve.

What Alternative Affordable Care Options Exist Beyond Traditional In-Home Care?

Supplementary care models such as adult day centers, respite programs, adult foster care, and community-based services deliver affordable support while complementing part-time home care and strengthening caregiver resilience.

What Are the Benefits and Costs of Adult Day Care for Seniors?

Adult day care centers provide structured daytime supervision, social interaction, and basic health monitoring at $60–$100 per day.

Primary advantages:

Social engagement through group activities.

Basic medical oversight—blood pressure checks, medication reminders.

Nutritional meals and transportation services in many centers.

By substituting full-time home visits with center-based support, families save on hourly home care rates and promote seniors’ social well-being.

How Does Respite Care Support Family Caregivers?

Respite care offers temporary relief for caregivers by providing in-home or short-term residential care, preventing burnout and preserving family harmony at $200–$400 per day.

Key benefits include:

Reduced stress and emotional exhaustion.

Continued continuity of care by trained providers.

Opportunity for caregivers to attend medical appointments or self-care activities.

Incorporating regular respite breaks sustains long-term caregiving capacity and improves overall care quality.

What Is Adult Foster Care and How Does It Compare to Other Residential Options?

Adult foster care places seniors in small, home-like settings with 24/7 support, averaging $2,500–$4,000 per month—often undercutting larger assisted living facilities. These homes foster personalized relationships and household integration, blending homeliness with professional oversight.

Choosing between options hinges on your willingness to assume employer responsibilities and desire for guaranteed coverage and training standards.

Where Can You Find Affordable Caregivers Through Non-Profit and Local Agencies?

Non-profit home care networks, Area Agencies on Aging, and faith-based organizations list vetted volunteers and subsidized aides at reduced rates or sliding-scale fees.

Common sources include:

Area Agency on Aging directories offering low-cost referrals.

Senior service nonprofits with grant-funded caregiver programs.

Local vocational schools where students gain experience through supervised internships.

These channels expand your candidate pool beyond private markets and often include additional support resources.

What Qualifications and Training Should You Look for in a Caregiver?

Certified Nursing Assistants (CNAs), Home Health Aides (HHAs), and caregivers with dementia-specific training ensure professional standards and safety.

Essential qualifications include:

State certification or licensure in personal care services.

Background and reference checks verifying reliability.

Specialized training in memory care, fall prevention, or chronic disease management.

Verifying credentials and ongoing education empowers families to select competent caregivers who deliver safe, affordable support.

What Legal and Financial Considerations Should You Know When Planning Affordable In-Home Elderly Care?

Planning for long-term home care requires proactive legal steps and asset management strategies that align with benefit eligibility and protect seniors’ autonomy.

How Do Medicaid Spend-Down Strategies Work for Eligibility?

Medicaid spend-down reallocates countable assets into exempt resources—such as prepaid funeral plans, home modifications, and certain trusts—to meet income thresholds without violating eligibility rules.

Key spend-down approaches:

Purchasing tax-qualified annuities to convert excess funds.

Funding home improvements that reduce countable assets while enhancing safety.

Establishing irrevocable funeral trusts to shelter assets.

By legally optimizing asset distribution, seniors qualify for Medicaid home care benefits sooner without undue financial sacrifice.

What Are Power of Attorney and Guardianship Roles in Elderly Care?

Assigning a durable power of attorney grants a trusted individual authority to make healthcare, financial, and housing decisions when cognitive capacity declines, while guardianship involves court-appointed oversight for incapacitated seniors.

Core distinctions:

Durable Power of Attorney – Selected by the senior; covers healthcare and finances without court involvement.

Guardianship – Court-assigned; often more restrictive and requires ongoing court reviews.

Establishing these roles in advance preserves seniors’ wishes, ensures timely decision-making, and reduces legal uncertainties.

Are There Tax Credits or Deductions Available for Caregiving Expenses?

The IRS offers the Child and Dependent Care Credit and medical expense deductions that apply to home health aide costs when care enables employment or addresses a chronic condition.

Applicable provisions:

Dependent Care Credit – Up to $3,000 for one qualifying adult or $6,000 for two or more, when care allows work.

Medical Expense Deductions – Unreimbursed expenses above 7.5 percent of adjusted gross income.

Utilizing these tax benefits lowers net caregiving costs and complements other assistance programs.

How Can Technology Make Affordable In-Home Elderly Care More Accessible?

Innovative telehealth, remote monitoring, and hybrid care platforms integrate digital solutions with traditional services to reduce travel-based visit hours and enhance safety at home.

What Remote Monitoring and Telehealth Solutions Support Seniors at Home?

Wearable sensors, motion detectors, and video check-ins allow professional oversight without daily in-person visits, cutting caregiver time by 20–40 percent.

Common features include:

Fall detection alerts via wearable devices.

Medication reminders through smart pill dispensers.

Virtual physician consultations for routine health checks.

These tools reinforce in-home caregiver support, promote timely interventions, and optimize resource allocation.

How Do Hybrid Care Models Combine Technology with Traditional Care?

Hybrid models blend scheduled in-home visits with on-demand remote support and adult day care sessions to create flexible, cost-efficient care plans.

Key components:

Scheduled visits for personal care and companionship.

Telecare check-ins to monitor vitals and well-being.

Adult day programs for social engagement and health oversight.

This integrated approach reduces total in-person hours while maintaining high-quality support and social interaction.

What Are the Most Common Questions About Affordable Elderly Caregiver Options for In-Home Care?

Seniors and families frequently ask how to combine government funding, private payment, and alternative settings to secure the most cost-effective care.

How Can I Get Paid to Care for a Family Member Through Medicaid?

Many HCBS waiver programs include consumer-directed care options that compensate eligible family caregivers at state-set rates, transforming informal support into formal employment.

What Is the Cheapest Option for Elderly Care?

Part-time in-home care supplemented by adult day services and community programs typically yields the lowest combined cost for moderate assistance needs.

Does Medicare Cover In-Home Care Services?

Medicare primarily covers short-term, skilled nursing and therapy services under home health benefits, but does not pay for long-term personal or custodial care.

What Are Alternatives to Nursing Home Care?

Cost-effective alternatives include HCBS waivers, adult foster care, assisted living, adult day care, and hybrid telehealth-enabled models that balance independence with professional oversight.

Families can mix and match these options to match care intensity with budget and personal preferences.

A clear understanding of funding sources, care settings, and emerging support models empowers seniors to create tailored, affordable in-home care plans without compromising quality or autonomy.

Aging in place remains achievable when families leverage layered assistance from government programs, community services, and technology. By comparing costs, exploring alternatives beyond traditional care, and applying prudent legal and financial planning, seniors and caregivers unlock sustainable solutions that honor dignity and independence. Start evaluating your needs, investigate local resources, and embrace hybrid care strategies to secure cost-effective support that truly fits your life.